Simplify Payments with Flexible Options

Simplify your payment process with flexible solutions. Easily manage partner payments, choose from multiple methods, and customize settings to fit your business needs. Enjoy seamless transactions and efficient financial management.

3 Steps to Process Payments to Partners

01

Create Cross-check

Choose the conversions that occurred within the timeframe you wish to validate. Select a period that suits your business needs, whether it’s weekly, bi-weekly, monthly, or any custom duration.

02

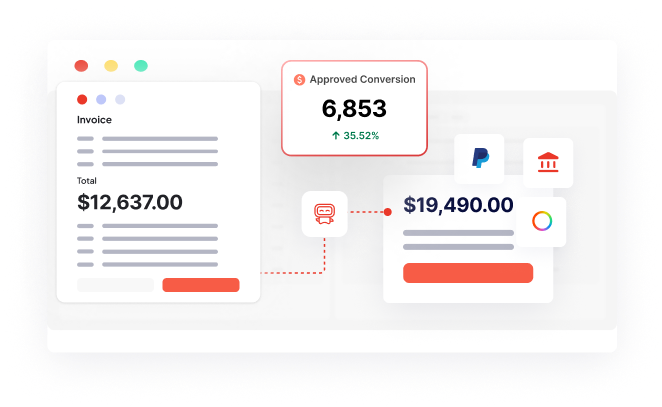

Validate Conversions

Verify that the conversions are valid and beneficial for your business. The timeframe for validating conversions can be flexible, depending on your product and business model.

03

Make the Payment

Pay for the validated conversions. Simply send the total payment amount to Permate, and we will handle the distribution. We take responsibility for ensuring that each partner receives their appropriate share of the commission based on the validated conversions.

Optimizes Your Payment Workflow

Flexible Payment Settings

Customize your payment settings to fit your needs. Choose the cross-check period, set conversion validation timelines, and schedule payments. This flexibility ensures the payment process aligns with your business operations.

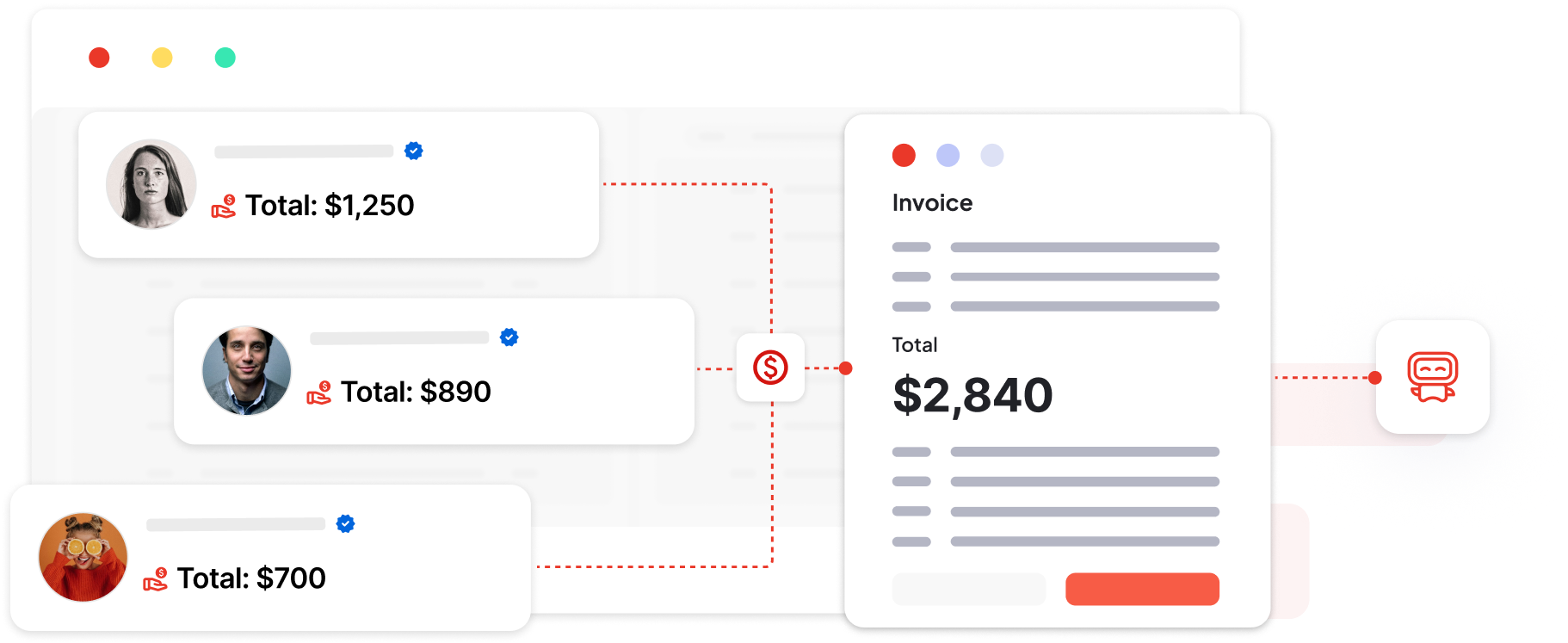

Simplified Partner Payments

Instead of managing payments individually for each partner, you can simply transfer the total payment amount to Permate. Permate will then take responsibility for distributing the funds to your partners, ensuring a seamless and efficient payment process.

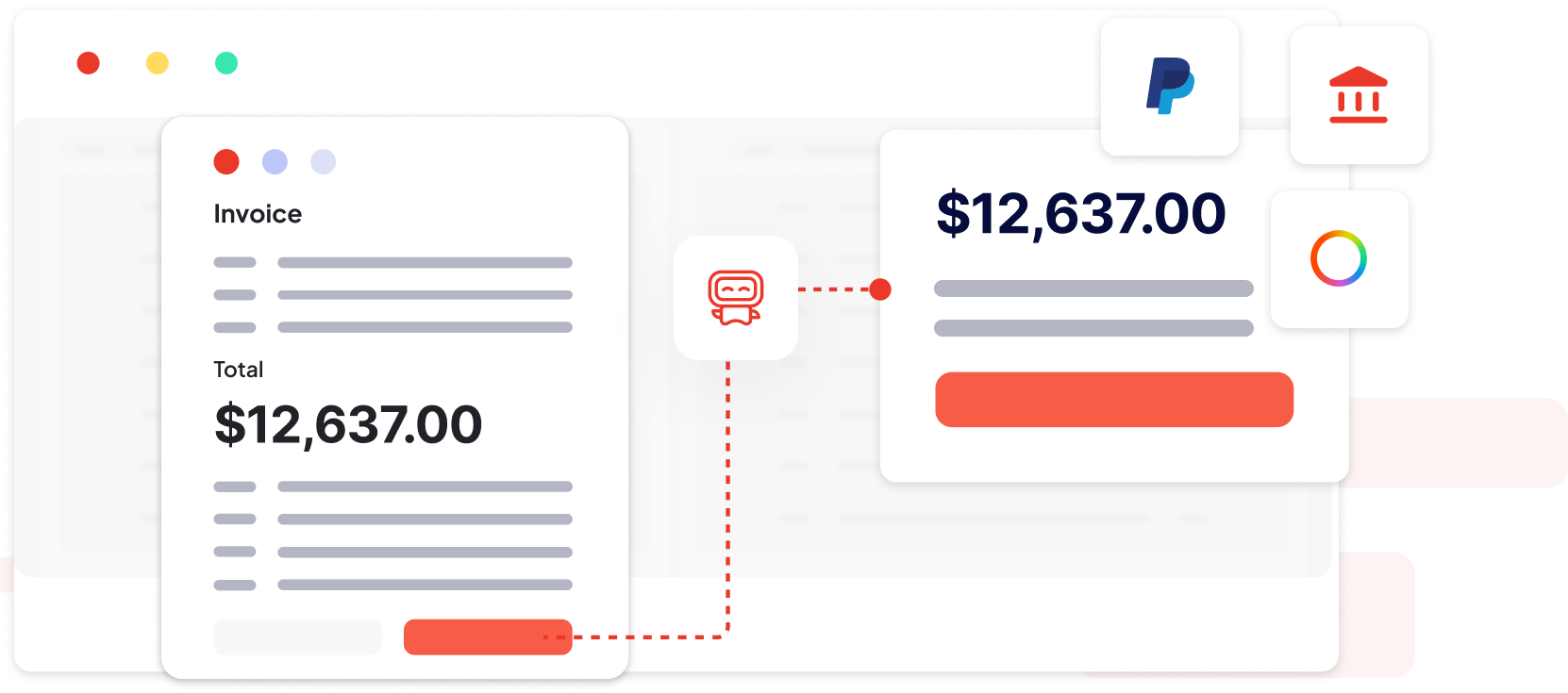

Multiple Payment Methods Supported

In addition to traditional wire transfers, Permate supports various other payment methods including PayPal and Payoneer. This flexibility allows you to choose the most convenient payment option for your needs.